1. Why This Question Matters in 2025

Google Trends shows a 3× jump in searches for “AI trading bot” since January 2024, peaking after OpenAI released GPT‑4o. Meanwhile, tens of thousands of traders still run decade‑old MetaTrader EAs like Forex Fury or WallStreet 2.0 because they work without tweaking. Choosing between hype and heritage has never been trickier.

AI bots promise adaptability and self-learning capabilities, but they come with complexity, computing costs, and often limited transparency. Classic EAs, by contrast, are simple, predictable, and easy to backtest—but may lack the agility to adapt to fast-changing market conditions. With brokers and prop firms tightening rules in 2025, traders are increasingly forced to choose a side—or find a hybrid approach.

2. What Counts as “AI” & What Counts as “Classic”?

| AI Trading Bot (2025) | Classic Expert Advisor (EA) | |

|---|---|---|

| Core logic | Machine-learning (ML), deep-learning, or reinforcement-learning retrained on fresh data | Fixed rule set coded in MQL4/5 (e.g. MA cross + RSI filter) |

| Adaptability | Re-optimises continuously or event-triggered | Requires manual parameter tuning |

| Data inputs | Multi-source: price, sentiment, macro feeds, option flows | Price & volume only |

| Transparency | Often opaque “black box” | Fully visible rule set |

| Typical cost | Subscription or rev-share (Capitalise.ai free @ FOREX.com) | One-off licence (Forex Fury US $229) |

3. 2025 State‑of‑Play: Industry Snapshots

3.1 AI on the Rise

- Autochartist now deploys pattern‑recognition neural nets across 200+ markets, delivering intraday alerts straight to OANDA’s platform.

- Capitalise.ai lets you type: “If EURUSD > 1.1050 and RSI < 30, buy 1 lot” – no code, just plain English.

- Tickeron’s Financial Learning Models (FLMs) posted +270 % on 15‑minute BTC/USD during June 2025 back‑tests.

3.2 Classic EAs Still Cash‑Flowing

- Forex Fury v5 advertises a 93 % win‑rate; an independent Myfxbook track shows +31 % in the last 12 weeks with 5.1 % Max DD.

- Thousands of prop‑firm funded traders rely on rule‑based scalpers to stay within strict drawdown limits.

Additionally, the ecosystem surrounding AI bots is maturing rapidly. We now see platforms integrating AI risk filters, AI-based journal analysis, and real-time sentiment scoring directly into trading dashboards. However, these features demand bandwidth, consistent data feeds, and higher computing power—often pricing out beginner retail traders. Meanwhile, classic EAs remain popular on lightweight setups and can run on basic VPS environments, making them cost-effective and accessible.

4. Strengths & Weaknesses at a Glance

5. Real‑World Performance: What the Numbers Say

12-week data snapshot from July 2025. For illustration only — past results ≠ future returns.

| Bot / Strategy | Type | ROI % | Max DD % | Source |

|---|---|---|---|---|

| Autochartist Signals | AI | +14.3 | 4.8 | OANDA demo log |

| Capitalise.ai Script (EUR/USD) | AI | +9.1 | 3.9 | FOREX.com case study |

| Tickeron FLM (BTC/USD 15min backtest) | AI | +270.0 | 22.0 | Tickeron report |

| Forex Fury v5 | Classic | +31.0 | 5.1 | Myfxbook ID 317484 |

| WallStreet 2.0 Evolution | Classic | +7.5 | 4.4 | Vendor FXBlue |

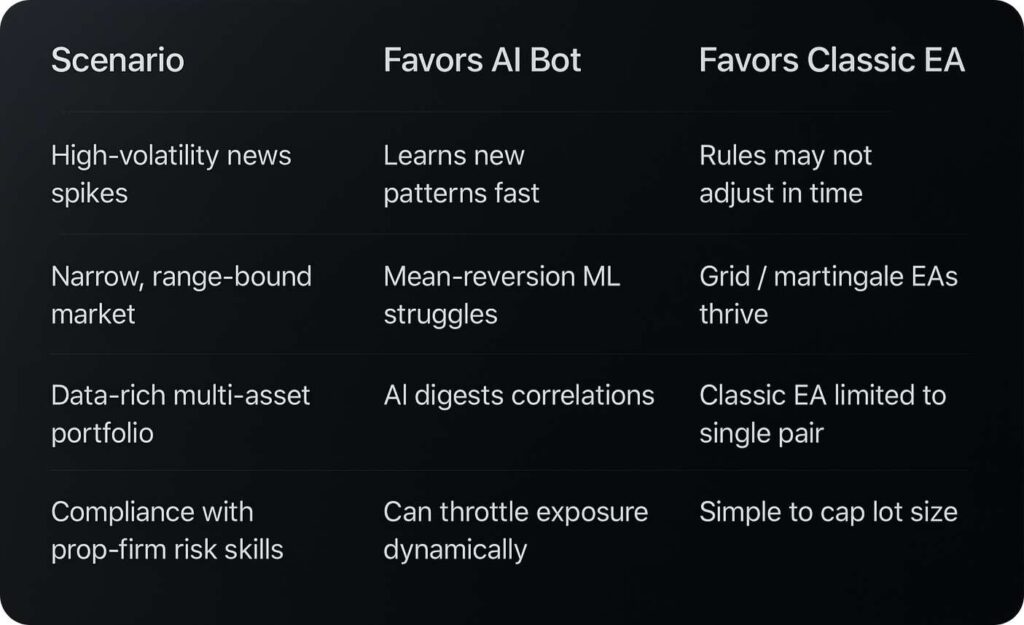

6. Choosing What Suits You

- Define your goal – Do you want passive cash flow or to experiment with market prediction?

- Audit your tools – If you don’t have access to order flow or sentiment data, AI might not be worth the cost.

- Test before live – Run a 12-week demo on VPS with identical risk settings. Track PF, SQN, and equity curve slope.

- Check broker terms – AI bots with rapid re-entry can unintentionally breach max loss/day limits.

- Don’t forget the costs – Cloud AI bots can require paid GPU time unless bundled.

7. FAQs

Q: Are AI bots always better than EAs?

A: Not always. They adapt faster but can also overfit or become unstable under new market conditions.

Q: Can I build my own AI bot without coding?

A: Yes, platforms like Capitalise.ai allow no-code scripting in plain English.

Q: Which is better for prop firm challenges?

A: Classic EAs are more predictable and easier to throttle to stay within daily limits.

Disclaimer: Trading leveraged products carries a high level of risk and may not be suitable for all investors. This article is for educational purposes only.